Hedge jouw energiebudget met PPA's

Power Purchase Agreements kunnen een belangrijk onderdeel van je energiestrategie zijn. Met een CPPA hedge je opgewekte hernieuwbare energie, on- en off-site, tegen een vaste prijs op lange termijn.

Reken op je Energy Manager voor de volledige begeleiding van je PPA’s: analyse van je energieverbruik en -doelstellingen, selectie van geschikte PPA-partners, opstellen en beheren van de contracten.

Waarom een PPA?

Een PPA biedt heel wat voordelen:

-

Als afnemer ben je zeker van een vastgelegd volume groene stroom tegen een interessant tarief, inclusief de Garanties van Oorsprong (GvO’s).

-

Als producent ben je zeker van opbrengsten van je hernieuwbare energie-installatie, wat de financiering vergemakkelijkt.

-

PPA’s dragen bij aan de energietransitie. Ze stimuleren de vergroening van de energiemix.

- PPA’s bieden jarenlange prijszekerheid. Dit in tegenstelling tot de fluctuerende marktprijzen.

Power Purchase Agreements (PPA's) versterken uw concurrentiepositie door uw energiekosten te stabiliseren, ze bieden langetermijntoegang tot hernieuwbare energie en helpen aan toekomstige regelgeving te voldoen. Als Belgisch marktleider in PPA's, bieden we een volledige ontzorging om dit strategisch voordeel maximaal te benutten.

Verbruiksanalyse als basis voor de juiste PPA

Je Energy Manager vertrekt vanuit jouw gedefinieerde energiestrategie. Op basis van je energieverbruik selecteren we de meest geschikte PPA. Hierbij worden gegevens verzameld over je historisch energieverbruik en je verwachte toekomstige energiebehoeften. We houden ook rekening met andere energiedoelstellingen, zoals het verminderen van je CO2-voetafdruk en het realiseren van kostenbesparingen.

PPA-modellen

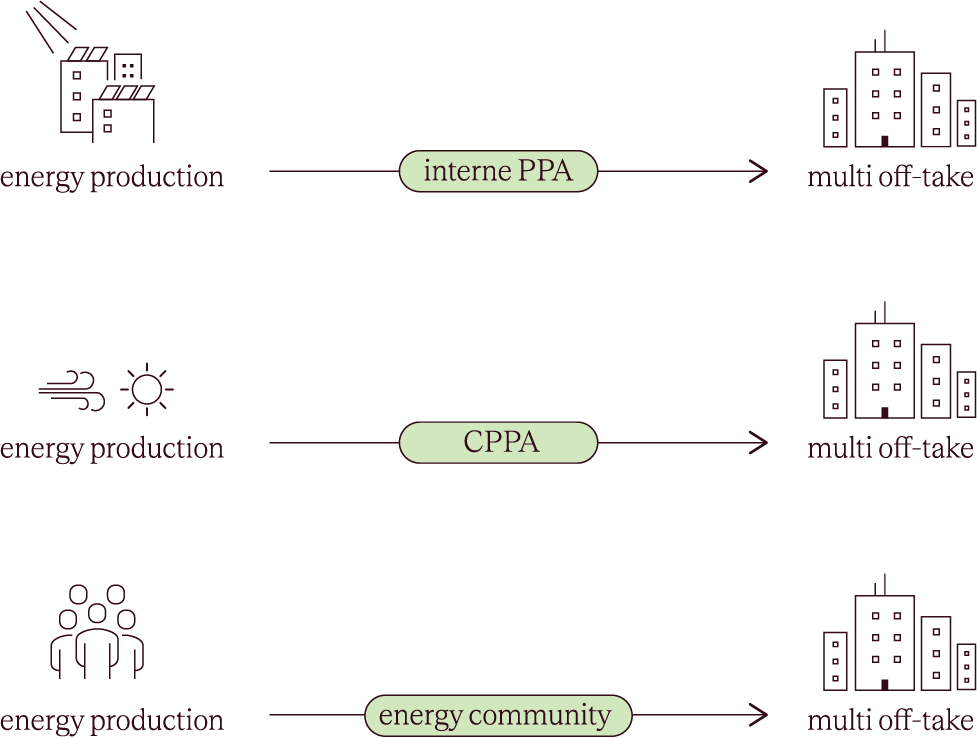

Er zijn verschillende modellen voor PPA’s, waaronder fysieke en virtuele stroomafnameovereenkomsten. De contracten kunnen volledig afgestemd worden op je specifieke behoeften. We lijsten hieronder enkele veelvoorkomende PPA-modellen op.

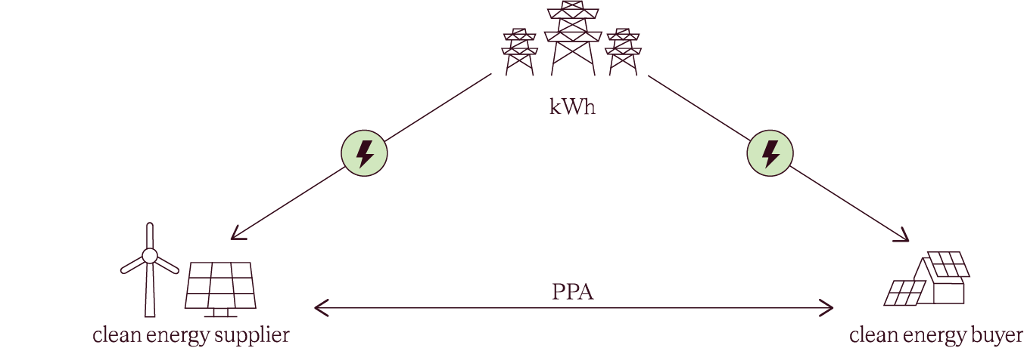

FYSIEKE PPA

Bij een

fysieke PPA

sluiten de energieproducent en de koper een overeenkomst voor de

fysieke levering

van elektriciteit. Dit type PPA wordt vooral gebruikt in de conventionele energiesector, waar de energiecentrale en de koper zich op

hetzelfde net

bevinden. De afrekening verzorgt de energieleverancier.

Financiële PPA

Een financiële of virtuele PPA is een contract waarbij de energieproducent en de koper een vaste prijs overeenkomen voor een bepaalde hoeveelheid elektriciteit. De koper krijgt geen fysieke levering van elektriciteit, maar een financiële compensatie die gebaseerd is op het verschil tussen de contractprijs en de marktprijs van elektriciteit.

De energieleverancier is bij deze constructie niet betrokken. De producent en afnemer injecteren en nemen af op dezelfde markt. De afrekening gebeurt via een financiële SWAP. Belangrijk hierbij is dat de stroom op kwartierbasis simultaan gematcht wordt, waardoor de uitkomst hetzelfde is als een on-site PPA.

Interne PPA

Een interne PPA is een overeenkomst tussen verschillende vestigingen van dezelfde onderneming. Dit type PPA is ideaal voor bedrijven met meerdere vestigingen of activiteiten, die veel elektriciteit verbruiken. Het voordeel? Het verbruik van je eigen installaties maximaliseren, een vaste prijs voor hernieuwbare energie en een kleinere CO2-voetafdruk.

MEER OVER PPA'S

Why a PPA within a

hedging strategy?

Which factors determine the PPA price?

LET'S TALK