Hedge your energy budget with PPAs

Power Purchase Agreements can form a key part of your energy strategy. With a CPPA, you hedge renewable energy generated on- and off-site at a fixed price for the long term.

Your Energy Manager will take care of the entire process of your PPAs: analysis of your energy consumption and goals, selection of suitable PPA renewable energy producers, preparation and management of contracts.

Why opt for a PPA?

A PPA offers multiple advantages:

-

As a purchaser, you are assured of a set volume of green energy at an attractive rate, including a Guarantees of Origin (GO).

-

As a producer, you are certain of the revenue from your renewable energy facility, which makes financing easier.

-

PPAs contribute to the energy transition. They stimulate an increasingly green energy mix.

- PPAs offer price certainty for many years, against a backdrop of fluctuating market prices.

Power Purchase Agreements (PPAs) secure your competitiveness by stabilizing energy costs, ensuring long-term access to renewable energy, and helping comply with future regulations. As a leader in Belgium for PPAs, AYA offers comprehensive support to help you navigate this strategic advantage.

Analysis of consumption as the basis for the right PPA

Your Energy Manager will take the energy strategy you have defined as a basis. We select the most suitable PPA based on your energy consumption. Data will also be collected on your historic energy consumption and your expected future energy needs. We also take into account other energy goals, such as reducing your carbon footprint and saving costs.

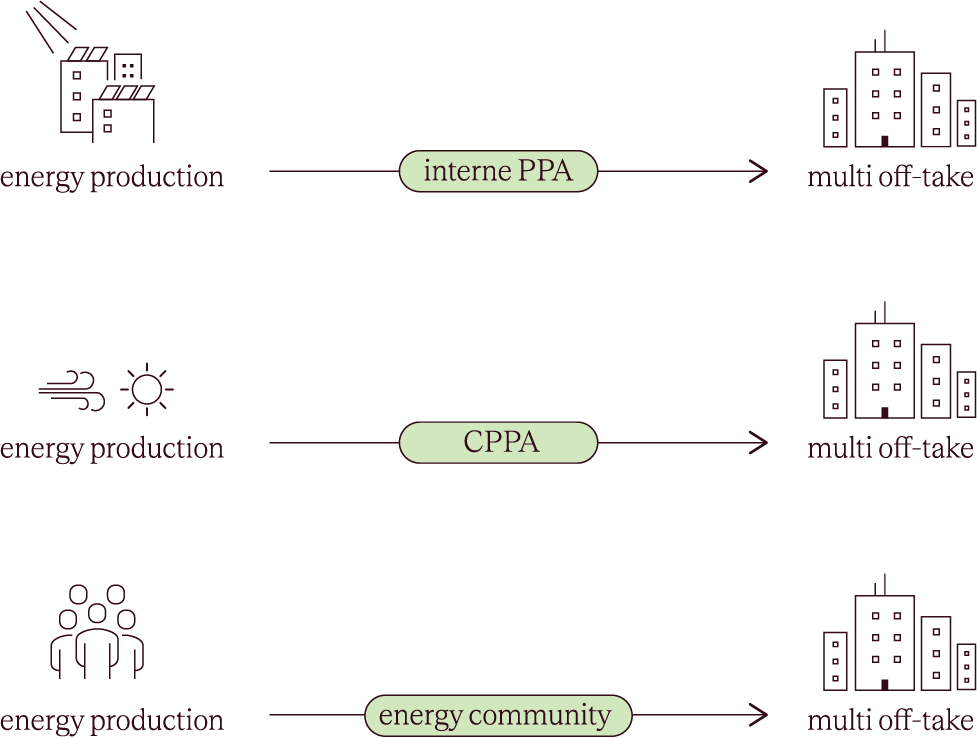

PPA models

There are several models of PPA, including physical and virtual power purchasing agreements. The contracts can be fully aligned to your specific requirements. Below is a list of some of the most common PPA models.

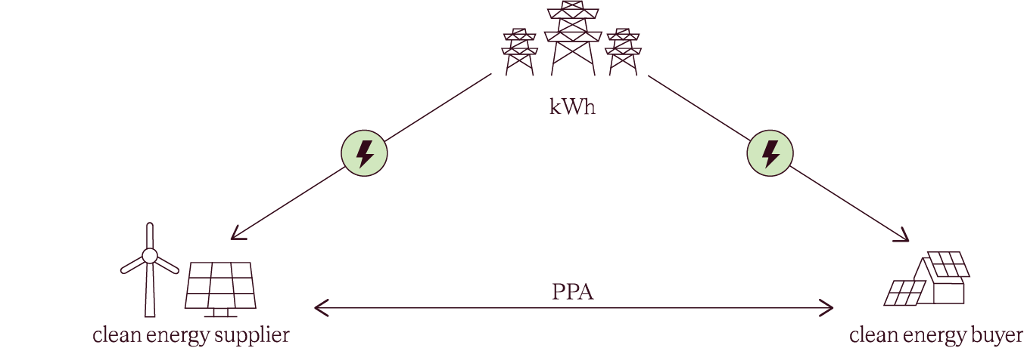

physical PPA

With a physical PPA, the energy producer and buyer enter into an agreement for the physical supply of electricity. This type of PPA is primarily used in the conventional energy sector, where the power plant and the purchaser are on the same grid. The energy supplier takes care of settlements.

Financial PPA

A financial or virtual PPA is a contract in which the energy producer and the purchaser agree to a fixed price for a certain quantity of electricity. The purchaser does not receive a physical delivery of electricity, but rather financial compensation based on the difference between the contractual price and the market price of electricity.

The energy supplier is not involved in this construction. The producer and purchaser inject and withdraw energy from the same market. The settlement occurs through a financial swap. It is important here that the energy is simultaneously matched each quarter, with the outcome being the same as with an on-site PPA.

Internal PPA

An internal PPA is an agreement between several branches of the same company. This type of PPA is ideal for companies with several branches or activities that consume a lot of electricity. The advantage is a maximisation of consumption from your own installations, a fixed price for renewable energy and a smaller carbon footprint.

More about ppas

Why a PPA within a

hedging strategy?

Which factors determine the PPA price?

LET'S TALK